In September 2022, EU Commission President von der Leyen announced the creation of a European Hydrogen Bank. The hydrogen bank should aim to reduce the cost gap between the consumers’ willingness to pay and the still high production costs for renewable hydrogen. This should help achieve the EU’s overall climate goals and the REpowerEU ambition for both domestic production and imports.

According to the European Hydrogen Bank Communication, the total investment required to produce, transport and consume 10 million tonnes of renewable hydrogen by 2030 is expected to be in the range of EUR 335 to 471 billion.

The first EU pilot auction closed in February 2024 and awarded only a small fraction of the total investment needed, namely EUR 720 million to seven renewable hydrogen projects. A second auction of EUR 2.2 million will be launched by the end of 2024 and will include a differentiated budget basket for maritime fuels.

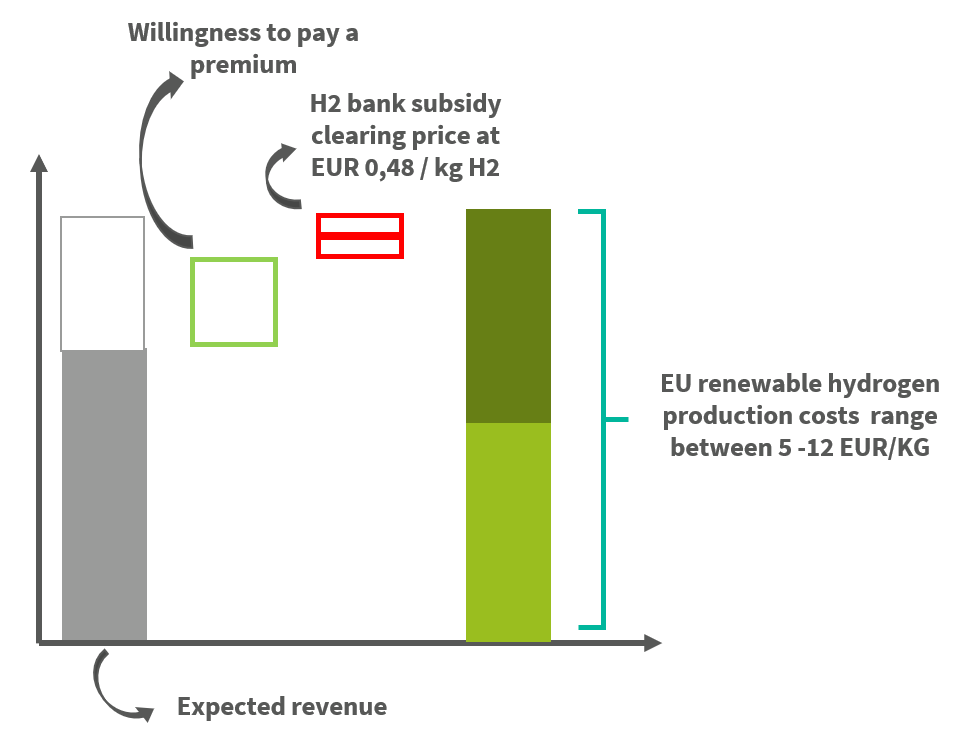

Unlike other auctions where the auctioned good is the product itself, during the first pilot auction bids were submitted to get support (in the form of a premium) to produce Renewable Fuels of Non-Biological Origin (RFNBOs). Bidders requiring the lowest level of support were to receive the subsidy.

The auction attracted 132 projects from 17 European countries. After evaluation, seven renewable hydrogen projects were selected. In total, the selected projects will cover 1.5 gigawatts (GWe) of electrolyser capacity and produce a total volume of 1.58 million tonnes of RFNBO hydrogen over ten years.

Key takeaways from the first pilot auction

- Remuneration in form of a premium has proven to be a simple and agile way to support renewable hydrogen production, de-risk projects and facilitate price discovery.

- From a ceiling price of 4.5 €/kg, the clearing price has been set at 0,48 €/kg. This means that, for now, the EU is getting a particularly good ratio in terms of the expected amount of H2 to be delivered: 1.58 million tonnes of RFNBO hydrogen over ten years and overall funds allocated through the auction (EUR 719.3 million).

- The median expected time to entry into operation was two years less (3 years) than the maximum allowed (5 years), indicating a high project implementation capacity and technological readiness.

- Polymer electrolyte membrane (PEM) electrolysers, followed by Alkaline electrolysers, were by far the preferred technological option.

- A higher willingness to pay is expected from off takers in the mobility sector (approx. 8 €/kg) compared to industry (approx. 6 €/kg).

- The winning bids are exempt from the obligation to comply with the ‘additionality’ principle for renewable electricity generation for 10 years. A monthly temporal correlation will also apply until 2030. These relaxed certification rules may have led to lower bid prices.

- Larger projects sizes and low electricity prices in some EU countries, have led to lower the capital expenditure (CAPEX) and operational expenditure (OPEX) of the winning projects, resulting in a lower levelised cost of hydrogen (LCOH).

- Regulatory mandates (industry targets) have increased the willingness to pay a premium for RFNBOs. This reinforces the argument that RFNBOs will only partially compete with grey hydrogen, as two separate markets may emerge.

- Germany made EUR 350 million available from its own national budget, which will serve hydrogen production in Germany. The auction as a service scheme is a mechanism through which Member States can make use of the EU-level auction platform and award national funding to additional projects.

Comparison of the main parameters of the first pilot auction and the draft terms and conditions for the second auction

| 1st pilot auction | 2nd auction (draft terms & conditions) | |

| Closing dates | February 2024 | 2024/2025 |

| Budget | 800 m. EUR | 1.2 bn. EUR |

| Auction ceiling price | 4.5 EUR/kg | 3.5 EUR/kg |

| Max. entry into operation | 5 years | 3 years |

| Budgetary baskets | All sectors combined | Separate basket of the maritime sector |